Trusted by leading brands globally

Introducing Tangelo ESG Collect

Our new companion product to the Tangelo platform, Tangelo ESG Collect, brings ESG data collection and reporting together in one seamless, structured workflow. It centralizes the gathering of both narrative and numeric ESG data from internal teams, suppliers, and systems, ensuring every disclosure is complete, consistent, and ready for reporting and tagging in Tangelo.

How it works

Tangelo ESG Collect follows five core steps that turn ESG data collection into a structured, auditable, and scalable process — from scoping what’s in, to planning, capturing, tracking, and assembling disclosure data ready for reporting.

Tangelo ESG Collect will be officially introduced later this year, with general availability planned from Q2 2026. The product is currently being implemented with selected clients as part of an early-access program, ahead of its full release.

ESG Reporting is not the problem. Data collection Is.

Reporting frameworks evolved. Data collection did not. That gap is now the real risk.

1. Scope

Define the scope of your ESG disclosures with ease. Tangelo ESG Collect supports ESRS (full and VSME), ISSB Standards, and local variants for Australia, Hong Kong, Singapore, and the UK — all maintained and updated by Tangelo. Each framework is delivered with its XBRL taxonomy for structured, detailed reporting and tagging.

Access maintained standards and taxonomies - work directly with ESRS, ISSB Standards, and local variants (AU, HK, SG, UK), always up to date.

Extend with entity-specific items - add your own disclosures and dimensions, including typed dimensions where applicable.

Record materiality decisions - capture the outcome of your (double) materiality analysis to define what’s in scope.

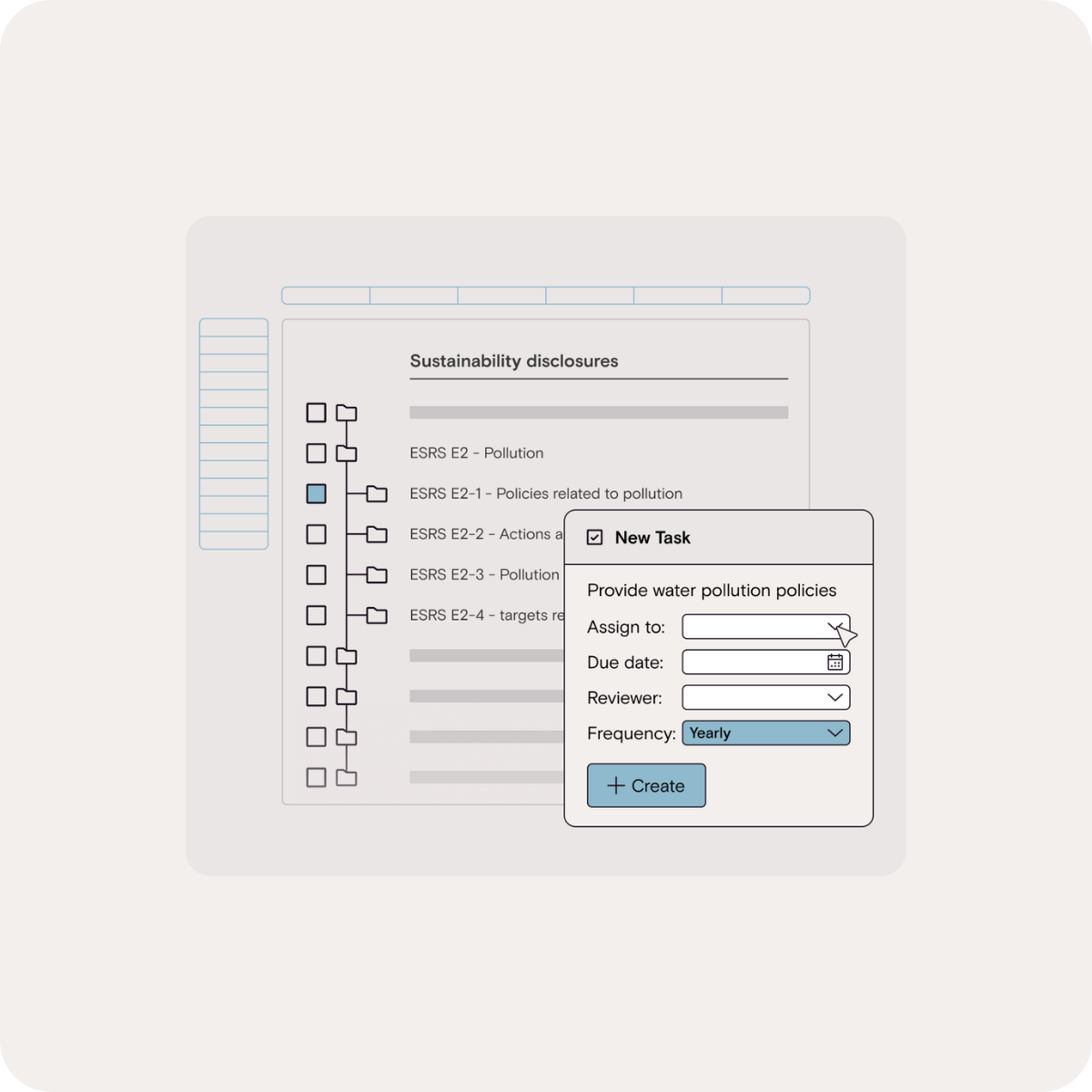

2. Plan

Transform scoped disclosures into a structured data collection plan. Define and group tasks, assign contributors, and set timelines — with flexibility to determine data granularity and carry content forward between reporting periods.

Define data collection tasks – group disclosure items into tasks, assign owners, and set deadlines

Apply dimensions and breakdowns – collect the right level of detail using standard or custom dimensions (e.g., country, gender)

Support multiple periods – collect data monthly, quarterly, or annually, with roll-forward between reporting periods.

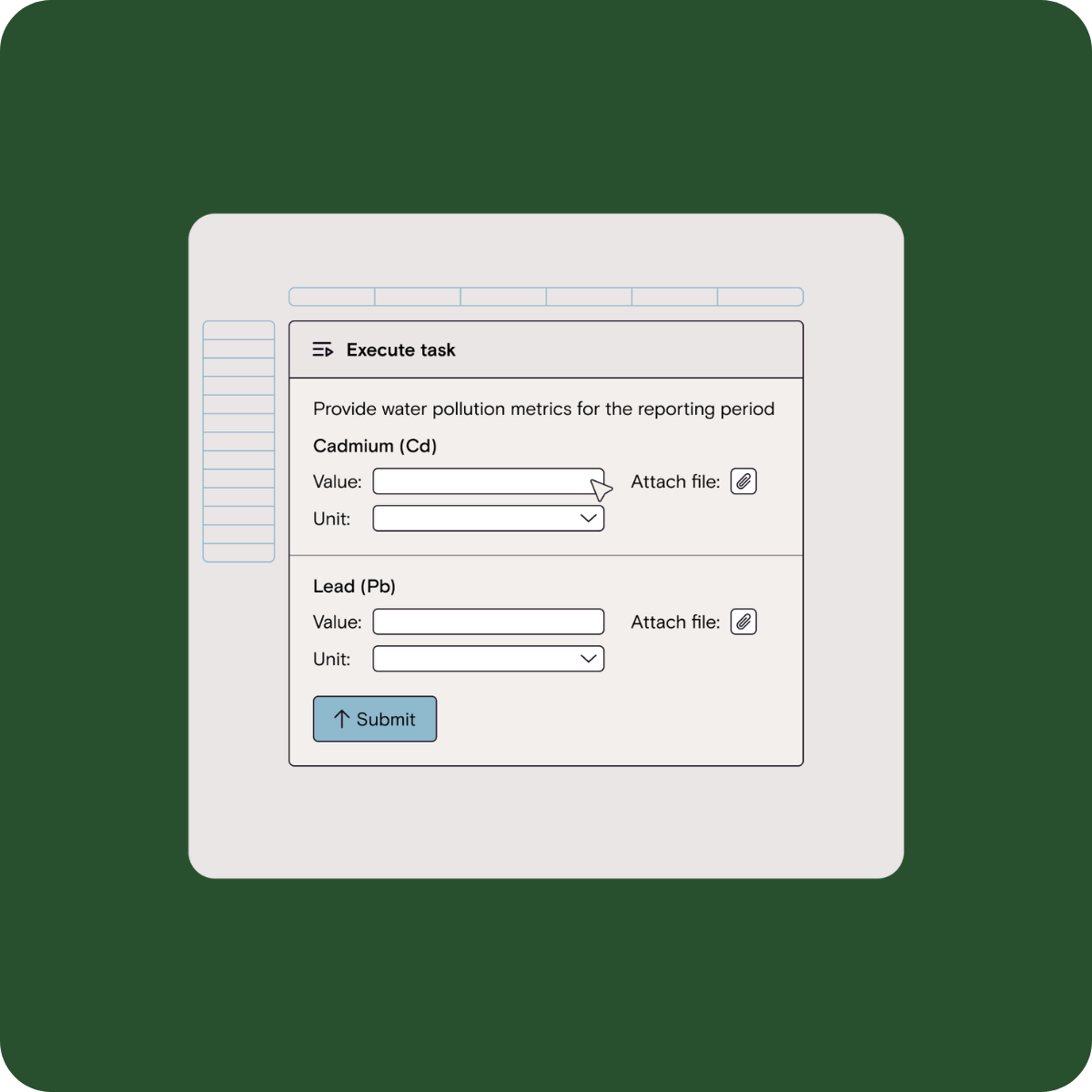

3. Capture

Make it easy for contributors to provide the right information — whether quantitative or narrative. Data can be entered directly in the system, uploaded via spreadsheets, or connected through integrations, with full visibility of prior reporting periods.

Provide data and evidence – complete assigned tasks, attach supporting files, and create typed dimensions where needed.

Use Excel templates – generate spreadsheets for bulk data entry, then upload for fast population.

Write narrative disclosures – capture qualitative inputs alongside quantitative data within the same structured environment.

Connect data sources – import data automatically from specialized systems (e.g., carbon disclosure platforms) via the hub functionality.

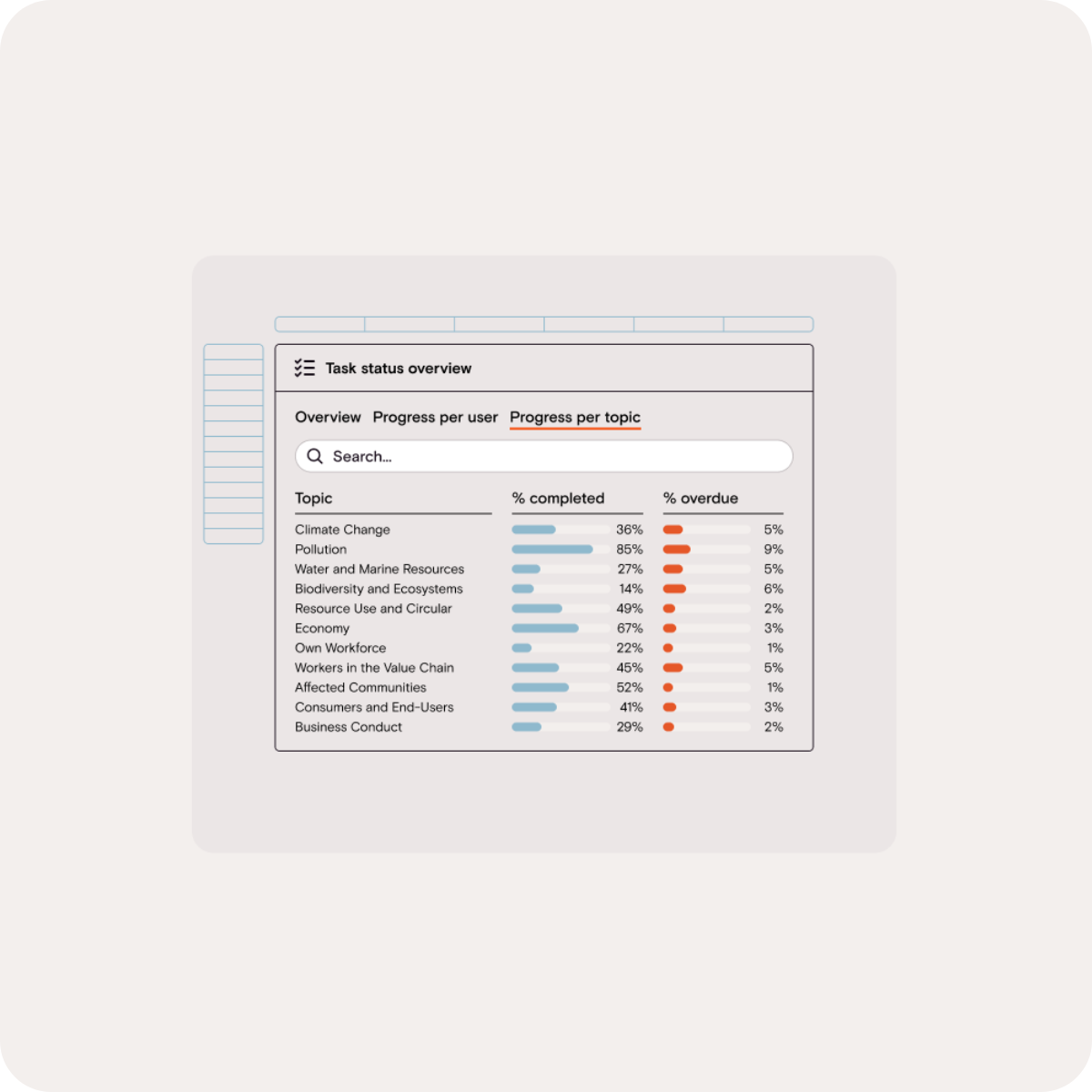

4. Track

Stay in control of your ESG data collection process. Monitor task progress in real time, send automated reminders, and oversee reviews and sign-offs — while also tracking ESG performance across key topics and targets.

Monitor task progress – see completions, bottlenecks, and status across contributors.

Send automated reminders – keep the process on track with smart notifications.

Oversee review and sign-off – manage approvals and maintain a full audit trail.

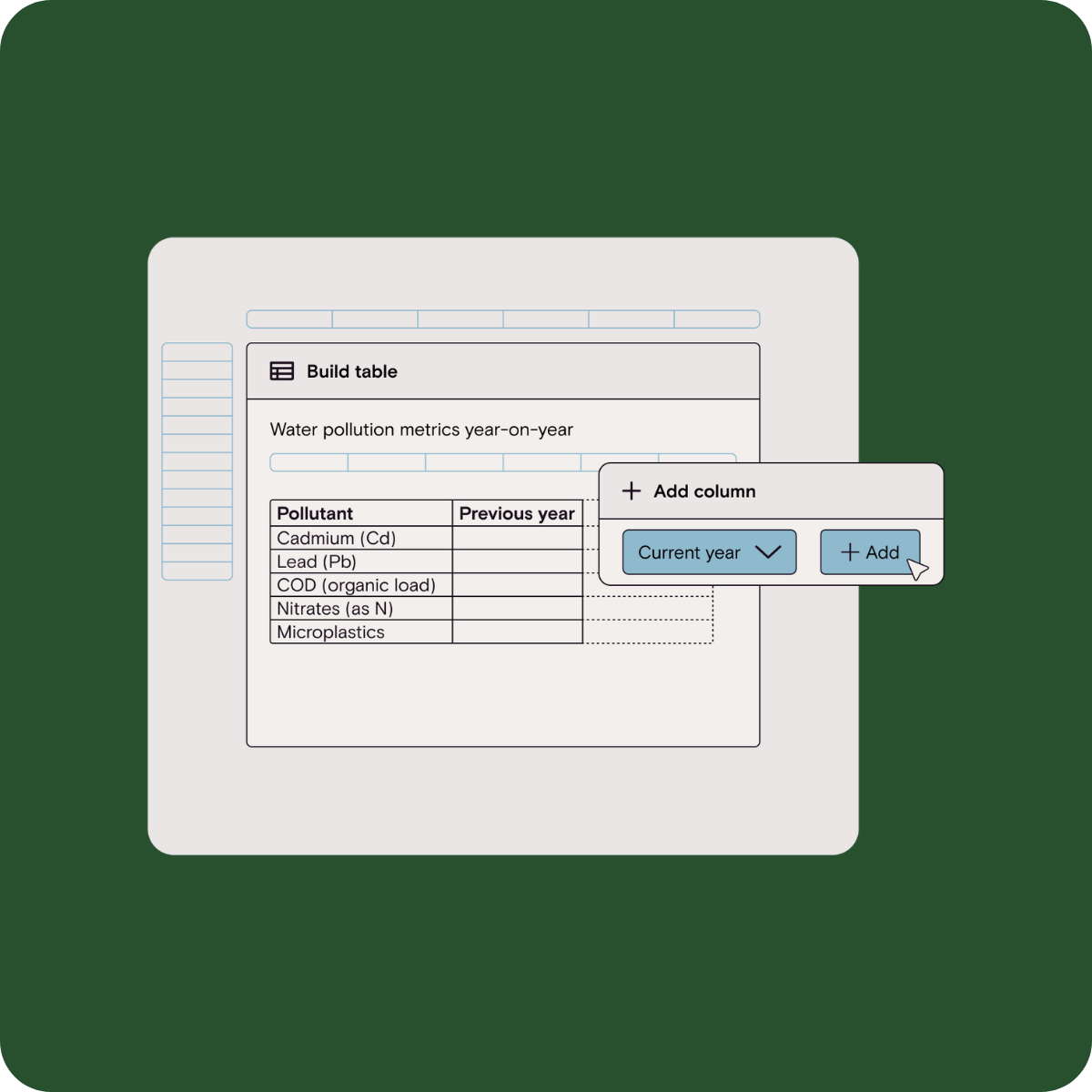

5. Assemble

Turn collected data into disclosure tables ready for both internal and external reporting. The guided builder applies the correct framework logic, dimensions, and reporting periods, with taxonomy links for automated tagging and audit trail data included by default when content flows into Tangelo.

Build disclosure tables – create tables with structured data and chart inputs ready for reporting.

Generate internal overviews – build tables for management reporting, dashboards, and validation.

Push to Tangelo – synchronize tables, narrative content, and figures directly with your report.

What ESG Collect brings

Turn fragmented ESG data into a single source of truth

Tangelo ESG Collect gives you broad coverage across all relevant sustainability topics. Instead of managing ESG metrics through a patchwork of spreadsheets and partial solutions, you get a single, structured environment to capture, validate, and enrich both narrative and numeric data. Tasks can be assigned across teams, deadlines monitored, and progress tracked — making the entire data collection process organized and auditable.

Go from disclosures to external report in one seamless flow

With Tangelo ESG Collect and the Tangelo platform working together, the ‘Collect & Report’ workflow becomes seamless. Disclosures are assembled directly in Tangelo ESG Collect and then flow into Tangelo, with taxonomy links and audit trail data carried forward automatically. This creates a controlled, end-to-end process — from collecting data to assembling disclosures and publishing high-quality reports across multiple channels.

Discover Tangelo ESG Collect

Collecting ESG data does not have to be complex or fragmented. Our factsheet gives you a clear overview of how Tangelo ESG Collect streamlines your ESG data collection and reporting, turning fragmented inputs into a single structured source of truth.

)

30k reports published, and counting

See a selection of corporate reports our clients produced in-house with Tangelo